Under The Bonnet, Chow Tai Fook Jewellery Group’s (HKG:1929) Returns Look Impressive

What trends need to we appear for it we want to detect stocks that can multiply in worth around the long time period? Firstly, we would want to identify a rising return on cash employed (ROCE) and then together with that, an at any time-expanding foundation of money utilized. Place merely, these types of companies are compounding machines, which means they are constantly reinvesting their earnings at ever-greater rates of return. Talking of which, we recognized some terrific modifications in Chow Tai Fook Jewelry Group’s (HKG:1929) returns on money, so let’s have a look.

Comprehension Return On Funds Utilized (ROCE)

If you haven’t worked with ROCE prior to, it actions the ‘return’ (pre-tax earnings) a firm generates from funds used in its business. Analysts use this components to estimate it for Chow Tai Fook Jewellery Team:

Return on Funds Utilized = Earnings In advance of Curiosity and Tax (EBIT) ÷ (Total Assets – Latest Liabilities)

.22 = HK$8.3b ÷ (HK$88b – HK$50b) (Primarily based on the trailing twelve months to March 2022).

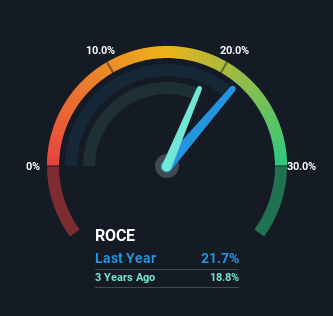

So, Chow Tai Fook Jewellery Team has an ROCE of 22{a0ae49ae04129c4068d784f4a35ae39a7b56de88307d03cceed9a41caec42547}. In complete conditions that is a wonderful return and it can be even better than the Specialty Retail sector typical of 11{a0ae49ae04129c4068d784f4a35ae39a7b56de88307d03cceed9a41caec42547}.

Our evaluation signifies that 1929 is probably overvalued!

Earlier mentioned you can see how the latest ROCE for Chow Tai Fook Jewelry Group compares to its prior returns on money, but you will find only so a great deal you can explain to from the past. If you’d like, you can check out out the forecasts from the analysts covering Chow Tai Fook Jewelry Team listed here for free of charge.

What Does the ROCE Trend For Chow Tai Fook Jewellery Group Explain to Us?

Chow Tai Fook Jewellery Team is demonstrating guarantee supplied that its ROCE is trending up and to the appropriate. The figures present that about the last 5 decades, ROCE has grown 57{a0ae49ae04129c4068d784f4a35ae39a7b56de88307d03cceed9a41caec42547} although using roughly the exact amount of capital. Mainly the business enterprise is producing higher returns from the identical total of cash and that is proof that there are improvements in the company’s efficiencies. It is worthy of searching deeper into this while for the reason that though it can be fantastic that the business enterprise is extra economical, it may well also necessarily mean that likely forward the regions to spend internally for the natural advancement are missing.

For the report although, there was a visible improve in the company’s present-day liabilities above the period, so we would attribute some of the ROCE advancement to that. The recent liabilities has greater to 57{a0ae49ae04129c4068d784f4a35ae39a7b56de88307d03cceed9a41caec42547} of overall property, so the company is now much more funded by the likes of its suppliers or short-term lenders. Provided it can be really high ratio, we might remind buyers that owning recent liabilities at these degrees can convey about some pitfalls in sure companies.

Our Choose On Chow Tai Fook Jewelry Group’s ROCE

To convey it all alongside one another, Chow Tai Fook Jewelry Group has completed properly to maximize the returns it’s generating from its capital employed. And a remarkable 136{a0ae49ae04129c4068d784f4a35ae39a7b56de88307d03cceed9a41caec42547} total return over the final 5 years tells us that investors are anticipating extra great points to occur in the long term. In light of that, we feel it is really worth on the lookout even further into this stock mainly because if Chow Tai Fook Jewellery Team can hold these tendencies up, it could have a dazzling future in advance.

Chow Tai Fook Jewellery Team does have some challenges even though, and we’ve noticed 1 warning indication for Chow Tai Fook Jewellery Group that you may be intrigued in.

Higher returns are a important ingredient to strong overall performance, so check out our cost-free listing ofstocks earning superior returns on fairness with reliable equilibrium sheets.

Valuation is complex, but we are helping make it uncomplicated.

Obtain out whether Chow Tai Fook Jewellery Team is likely about or undervalued by checking out our complete analysis, which incorporates good worth estimates, risks and warnings, dividends, insider transactions and economic overall health.

Check out the Cost-free Analysis

Have opinions on this short article? Involved about the content? Get in touch with us immediately. Alternatively, electronic mail editorial-group (at) simplywallst.com.

This short article by Basically Wall St is common in nature. We provide commentary based mostly on historical knowledge and analyst forecasts only utilizing an impartial methodology and our content are not meant to be fiscal information. It does not constitute a recommendation to obtain or promote any stock, and does not get account of your goals, or your financial situation. We aim to bring you prolonged-time period focused assessment driven by essential information. Observe that our assessment may possibly not factor in the newest price-delicate company bulletins or qualitative material. Simply just Wall St has no placement in any shares mentioned.