Sneakers, more than a speedy growing product, is culture now

If any product category in non-apparel lifestyle products in the last 4-5 years has attracted youth the most, it is sneakers which is undoubtedly on the top. The international sneaker market is probably unique in the way it’s constantly moving between innovation and nostalgia. Sneakers can be worn with any kind of attire and anywhere, right from a party to workplace or while workout. It is believed that due to the growing health concerns amongst youth, sneakers are preferred as they ensure style and comfort both. More than a fashion product, a hobby or a passion, sneaker is now a culture. Nearly all stakeholders in the fashion and shoe segment, be it international or national brands, start-ups, D2C selling platforms, manufacturers or B2B marketplace, are enthusiastic about the growth of this product category.

Massive market, impressive growth

Various international research reports claim that the worldwide sneaker market value is US $ 86.86 billion, and with around a CAGR of 6.8 per cent, it is expected to reach US $ 139.8 billion by 2032. With regard to India, revenue in the sneakers segment amounts to US $ 3.01 billion in 2023. The market is expected to grow annually by 5.88 per cent CAGR during 2023-2027.

Compared to the Western world, sneaker culture arrived a bit late in India, but as Bollywood sets trends here more than any other form of media, a massive spike in sneaker sales was observed after the release of the movie Gully Boy (2019). To create a buzz in the market, there are focused events In India for sneakerheads like Indian Sneaker Convention, Sneaker Festival and specific Sneakerhood campaigns too.

Indeed there is no such place across the retail world, where the sneaker market is not booming, however mainly the market in India can be classified into majorly three segments: first, the international top brands like Nike, Adidas, Puma, New Balance, Converse, Fila, Vans, Asics, Skechers, Veja, Reebok, Salomon, Common Projects, Hoka, Bata, The Underdogs, Aldo, Veja, Diesel, Steve Madden, Replay, Decathlon, Superdry Levi’s and UCB to mention a few. Many of these are enjoying good growth in India.

The second is leading Indian platforms (marketplaces) like VegNonVeg (India’s first multi-brand sneaker store), The Mainstreet Marketplace, Crepdog Crew (CDC), Superkicks, SoleSearch and start-ups or brands like Neeman’s, 7-10, Sko, Thaley, Flatheads, Elevar, Saree Sneakers, Badhuche.

The third segment is Indian footwear/apparel brands, manufacturers which now have stronghold in sneakers like Red Tape (Mirza International Limited), Woodland, Alcis, Relaxo, Liberty, Campus and Asian etc. Retailers like Blackberry are also offering this product category.

Indian brand Neeman’s has seen almost 15 times growth in the last one year and sold over 7.5 lakh pairs in the last three years, and served more than 5.5 lakh customers in the segment. The typical customer of the brand is aged between 28 and 40 years and resides in metro cities. But overall sneaker craze is not limited to metro cities as the sale of sneakers extends beyond the metros. Millennials, Gen Z, women are buying as many sneakers as men.

Since its inception in 2019, CDC has expanded from an Instagram page to a website to a 6,000 square feet flagship store (houses the biggest sneaker wall in India) and it has plans to soon open an experiential retail store in Mumbai. It claims to witness 350 per cent year-on-year growth since 2019.

Established Indian fashion sports brand Alcis started sneakers two years back and is continuously adding new styles. The company has witnessed 20-30 per cent Y-o-Y growth in sneakers, so it is also increasing its offering in this category. It is known to have developed 100 styles last year.

One can’t ignore the presence of sneakers on e-commerce platforms like Amazon, Tata Cliq, Myntra, Flipkart etc., which are also the main propagators and sellers of sneakers not only for Indian brands but also for international brands which are usually not available in the local market. Myntra added ‘New Balance’, on its platform. To tap the Indian market, Saucony (124- years-old American brand) is present with its specific Indian website and across many stores and exploring the dealer network too.

Not only direct consumer-related brands, start-ups or such platforms, B2B Marketplaces are also focusing on this segment. Moglix, comparatively a new tech-enabled sourcing platform that serves as a one-stop solution for lifestyle brands, started offering sneakers four months back. The company is mainly into trendy sneakers which are from the mid-premium affordably priced segment and Amit Gupta, Director, Fashion & Lifestyle, Moglix feels that the same has been much in demand. He states, “Our experience has been amazing in this product category and we are expecting that sneakers will be 40 per cent of the non-apparel business of the company in the next one year.”

Having strong presence in physical retail, Bata India has introduced new Sneaker Studios in stores which showcase 300 styles and nine brands. It has seen the demand for the sneaker category grow by 40 per cent in the last few years.

Flatheads Shoes, gaining momentum for premium sneakers, was recently a point of discussion as its Co-founder Ganesh Balakrishnan, who is also an IIT-IIM graduate, appeared in Shark Tank India. He believes that the Indian sneakers market has evolved and with the tremendous opportunities, this is the best time for premium range sneakers’ companies to create their strong space in India. He tells Apparel Resources (AR), “Various collaboration initiatives of international brands are now more visible to Indian consumers. At the same time, now youth are self-conscious about their lifestyle and overall appearance. We are also expecting good growth.” Flatheads started just before Covid and now after its appearance in Shark Tank, it is geared up to grow.

Niche focus

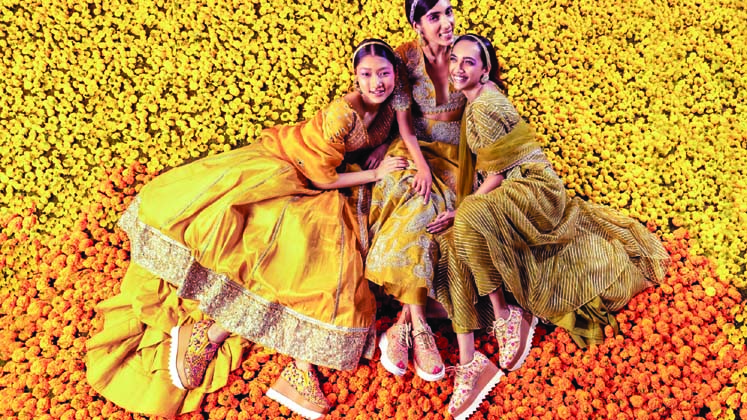

Interestingly, there are emerging brands that are very niche in this segment and have highly value-added sneakers. Embroidered sneakers are one such part. Kolkata-based The Saree Sneakers (Cute Little Fashions) is specifically known for its hand-embroidered sneakers and it also offers sneakers for bridals. It also has customised service to prepare sneakers as per the wearer’s outfit or choice. In Mumbai, the recently launched Anaar came up with a one-of-a-kind bridal sneaker wedge range, infusing style with comfort for this wedding season. It makes both flat and high-heeled sneakers.

Talking about her initiative, Tanushri Biyani, Founder, Anaar says, “Weddings are a huge thing in India and sneakers have a widespread consumption.”

Anaar has a small unit where its sneakers are meticulously handcrafted. Each pair can take up to 50 hours to make. It truly believes that fashion doesn’t have to be uncomfortable, and that is the main manufacturing aspect of Anaar. Anaar also has plans to launch sneakers for men as well.

“Various collaboration initiatives of international brands are now more visible to Indian consumers. At the same time, now youth are self conscious about their lifestyle, and overall appearance. We are also expecting good growth.” Ganesh Balakrishnan Co-founder, Flatheads

Manufacturing also evolving with growing market

The Indian sneaker manufacturing industry is getting more matured as many international brands’ sneakers are being produced in India for Indian markets as well as overseas. Ganesh from Flatheads has witnessed investment taking place in this segment and is hopeful that in the next 3-4 years, there will be much more development on the manufacturing front.

However, the pain point of manufacturing sneakers in India is mainly regarding raw material as there are limitations to their availability and trained manpower.

Amit Kapoor, Director, Kaps Overseas, Agra is working with top sneakers brands like Neeman’s, Lee Cooper and Thaely etc. Kaps Overseas has a monthly capacity of manufacturing 1.25 lakh pairs of footwear and 65 per cent of this belongs to sneakers. The company has further expansion plans also and has started manufacturing raw materials for sneakers.

“As of now we have monthly capacity of manufacturing 1.25 lakh pairs of footwear and 65 per cent of this is sneakers. We have expansion plan for sneakers and in long run we can start the manufacturing for sneakers’ raw material also.” Amit Kapoor Director, Kaps Overseas, Agra

In fact, sneaker manufacturing is growing rapidly across all shoe manufacturing hubs and Agra is not an exception. There are a few good manufacturers in the city that produce sneakers for top brands such as Dawar Footwear Industries, Virola Shoes, Lamba Footwear Industries and VRD Exports to name a few. Chennai, Ranipet, Noida, Bahadurgarh in Haryana are also hubs for sneaker manufacturing.

Rohit Aneja, Partner, Paragon Apparels (Alcis) agrees that now manufacturing strength of sneakers is growing in India as he says, “We were earlier importing sneakers from China but to serve Indian consumer taste better now, all our sneakers are being sourced from Indian factories.”

Focus on being sustainable

Innovative raw materials, especially for shoe’s upper part are being developed with increased thrust on comfort and sustainability, Hyderabad-based sustainable shoe brand Neeman’s claims that every product of the brand is made using natural, renewable and sustainable materials, be it recycled PET bottles, Australian Merino wool, 100 per cent natural cotton, knitted fabric and stretchability ensuring that the product is breathable. The start-up founded by Taran Chhabra and Amar Preet Singh has received good funding so far and its major sourcing of sneakers is from Agra. Its shoe uppers are made with mango pulp, mushroom and so on.

For few sneakers brands, sustainability is at the core like budding start-up Thaely started with specific sneakers that only use components recycled from waste materials. It claims on its website that the aim of the exercise is to find a solution to the problem of the 100 billion plastic bags used each year that use 12 million barrels of oil and kill 100,000 marine animals annually.

Flatheads offers sneakers for casual work dressing and its innovative sneakers are made using natural materials such as linen, bamboo yarn and banana stem fibres.

Using canvas made from organic cotton and a variety of other raw materials like recycled rubber for the sole, Amit Kapoor also believes that there are limitations in the availability of raw material, so sometimes they have to import it. He is also hopeful that with the growing demand of sneakers and the tilt of the industry towards sustainable material, there will be increase in the availability of the same. In the long run, he also has plans to invest in manufacturing of raw materials.

In-house design development is priority for many

While the top brands start working on their design development around 1-2 years ahead, emerging brands and start-ups normally work six months ahead. Thrust is majorly on in-house developed designs.

Moglix’s in-house design and sourcing team supports vendors regarding product development and even helps them to source better raw material. Its design team also works with similar teams of various brands and comes out with effective results. Even Alcis sells its own designed sneakers as it has a full-fledged in-house design team.

For budding start-ups, small orders and speed to the market are major concerns and they work accordingly on their product development. For Flatheads, the turnaround time is around 90-100 days and its design development, replenishment are based on market intelligence. “For us, speed to market is very important and we offer small quantities with many design options,” says Ganesh.

Extremely fashion-forward Anaar plans design six months in advance as currently it is working on monsoon wedding range. It plans about the kind of materials, colours, styles and designs which can be used and explores the ones in trend.

Few of the leading brands give their own designs also to their vendors and sell products designed by their vendors purely. To come out with the best design, brands and vendors work collectively on product development, exchange a lot of ideas and follow each other’s suggestions. Amit Kapoor also follows similar kind of process with the top brands which are his clients for years.